Qbi deduction calculator

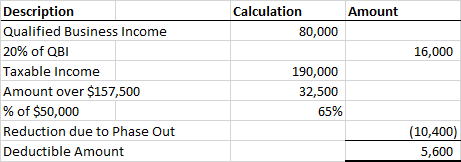

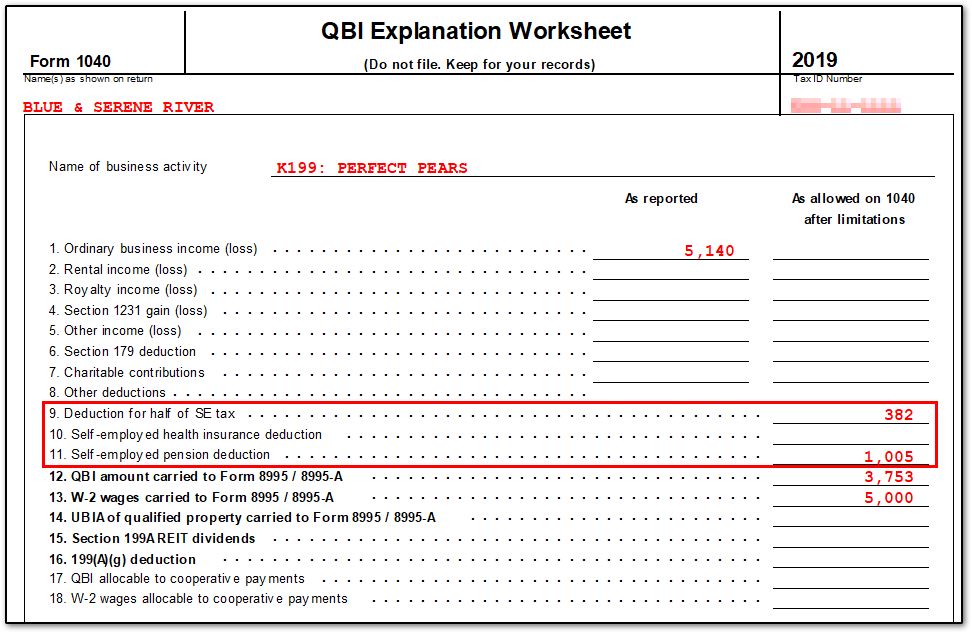

20 of QBI reduction ratio excess amount QBI deduction. A qualified business income deduction.

1040 Tax Planner Qualified Business Income Deduction Drake17

157500 if single estate or trust.

. Prior Year 199A Deduction Calculators Phase-In Taxable Income Threshold 2020 Calculator 2019 Calculator. QBID Calculator updated for 2019. How to Calculate Qualified Business Income QBI on the 1040 1 Presented By.

78 rows QBI Entity Selection Calculator This worksheet is designed for Tax Professionals to. How to Calculate a Qualified Business Income Deduction. Difference Between QBI and Greater of WagesAssets Reduction to QBI Phaseout Deduction Calculation for Non-Service Business Above Phaseout 20 of QBI or Defined Taxable Income.

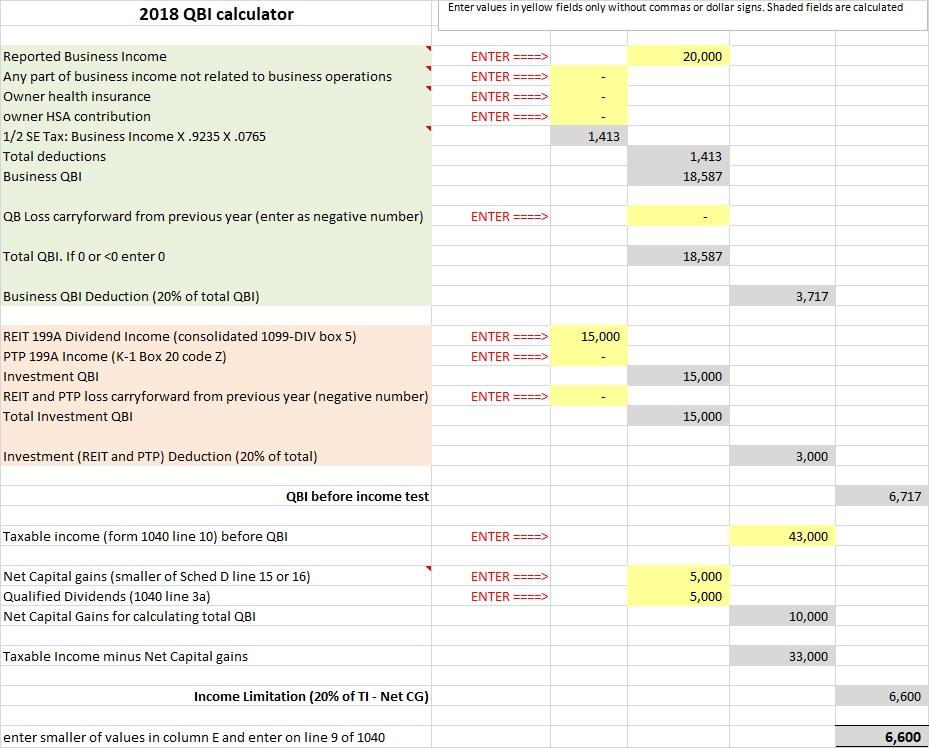

SCHEDULE CONSULTATION QBI Calculator 2021 This calculator will calculate your applicable Qualified Business Income Deduction also known as the Pass-Through. Status Beginning Ending 2018 Calculator. Help you understand how to use ProSeries to calculate the QBI deduction.

199A Deduction Calculator 2018 Enter Information Single or Married Enter then tab to next cell Taxable Income Net Capital Gains and Dividends. Tax before QBI deduction. 60000 0702 27500.

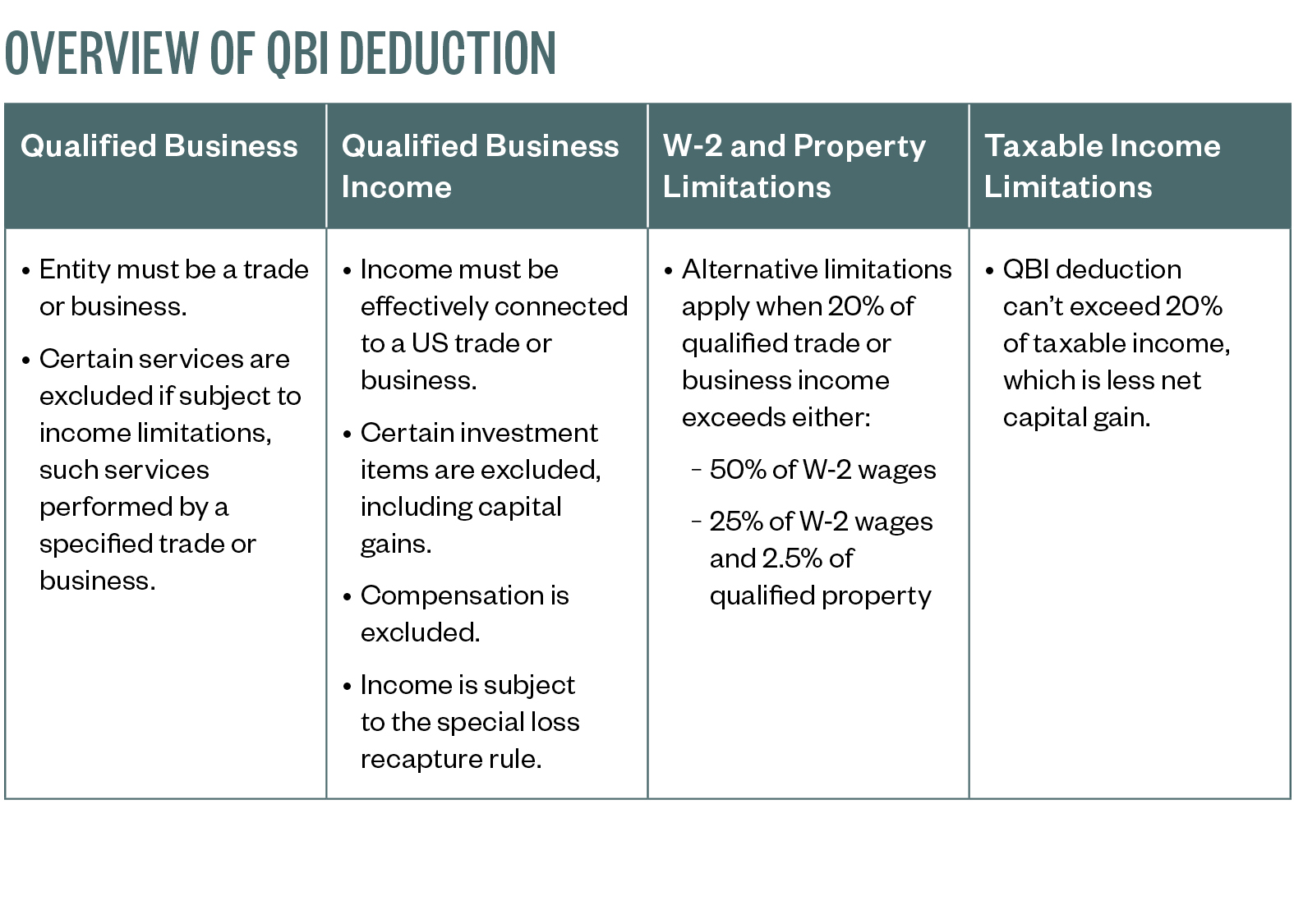

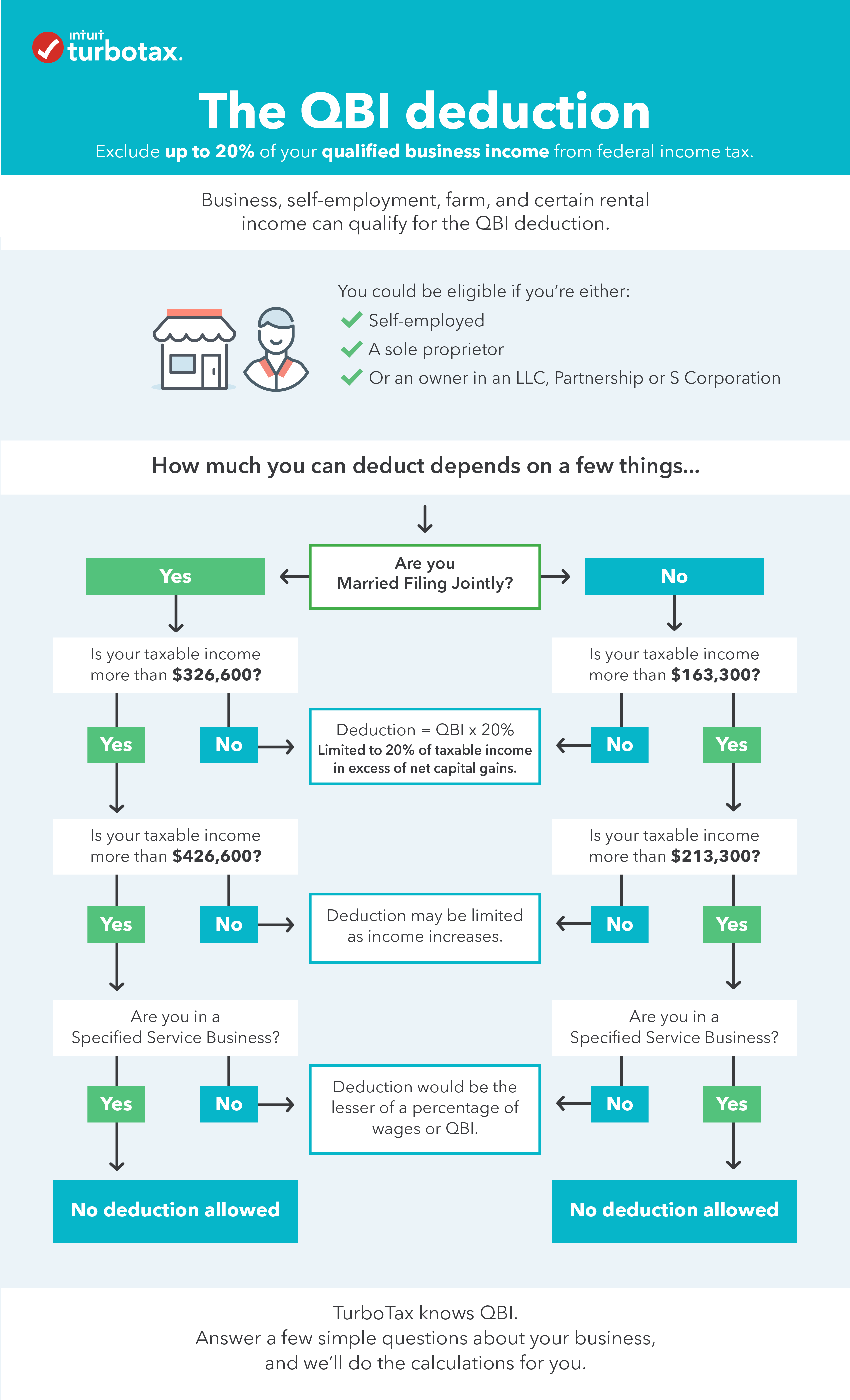

Tax after QBI deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and. Jul 15 2021 4 min read.

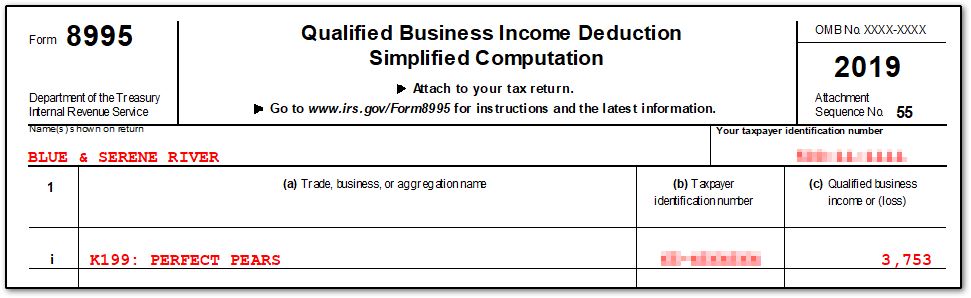

The QBI deduction will flow to line 10 of Form 1040 or 1040-SR or line 38 of Form 1040-NR. The QBI deduction for Jack and Jills restaurant business works out to. 1 Total calculated QBI deductions for all PTBs included below.

There are two ways to calculate the QBI deduction. Intuit ProConnect has developed the QBI Entity Selection Calculator to provide in-depth computations of the qualified business income deduction according to IRS. You have QBI qualified REIT dividends or qualified PTP income or loss.

2 Deduction for Qualified Business Income. Using the simplified worksheet or the complex. This article provides general information about the qualified business income QBI deduction so you can learn more about how it works and the scenarios that apply to it.

Were concerns about how to determine net capital gain for. Larry Gray CPA CGMA National Association of Tax Professionals. The QBID Calculator is no longer active on the Tax School website.

Qualified Business Income QBI For.

20 Qbi Deduction Calculator For 2021

Calculation Of The 20 Deduction For 2018 Pass Through Entities Steemit

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

New Qualified Business Income Deduction

Qbi Calculator Wilson Rogers Company

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

2

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Overview Of The Qualified Business Income Qbi Deduction

How To Calculate The 20 199a Qbi Deduction Very Detailed 20 Business Tax Deduction Explained Youtube

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

20 Qbi Deduction Calculator For 2021

Do I Qualify For The Qualified Business Income Deduction